BLOG

Blog

A 1031 Exchange is a powerful tool for investors looking to defer capital gains taxes and reinvest their equity. While the process can be complex, it follows a clear structure, and with the right guidance, it can be a smooth and strategic move. Here’s a quick look at the four key steps involved in a successful 1031 Exchange: Step 1: Build Your Strategy The first step in a 1031 exchange happens before you list your property or begin marketing. It’s essential to identify and connect with a Qualified Intermediary (QI) who will play a central role in the exchange process. QIs ensure compliance with IRS rules and deadlines, state laws, and closing procedures, but not all QIs are created equal. Working with an experienced, responsive QI can make all the difference in keeping your exchange on track. During your initial strategy call, the QI will help you: Understand the requirements of a 1031 Exchange Evaluate how those requirements apply to your specific transaction Plan ahead for identifying and acquiring a replacement property Ten31 Texas Tip: Start discussions with a qualified QI early to help avoid costly mistakes and ensure you’re prepared for the strict timelines that follow. A quick strategy call early on can save you time, stress, and money down the road. Step 2: Close on Your Relinquished Property Once you’ve accepted a contract and are ready to close, your QI prepares the necessary exchange documents. At closing, the QI receives the net proceeds from the sale and holds them as “exchange funds.” This is a legal requirement of the IRS, and if the investor takes possession of the funds, even briefly, the exchange could become disqualified. From the closing date (Day 0), two critical deadlines begin: 45-Day Identification Period: You must identify potential replacement properties within this window. 180-Day Exchange Period: You must complete the purchase of one or more identified properties within this timeframe. Ten31 Texas Tip: Make sure everyone involved in the transaction (your agent, title company, and QI) is aligned with your strategy. The IRS deadlines are firm and missing them by a day can invalidate your exchange. Step 3: Identify Your Replacement Property During the 45-day Identification Period, you’ll submit a signed identification form to your QI listing the properties you may want to purchase. The IRS provides three identification methods to help investors structure their exchange based on property type, value, and strategy. Three-Property Rule: Identify up to three properties, regardless of value. 200% Rule: Identify any number of properties, as long as their combined value doesn’t exceed 200% of the relinquished property. 95% Rule: Identify any number of properties, but you must purchase at least 95% of their total value. This is a high-risk option that should be used when the first two rules don’t apply. Ten 31 Texas Tip: D on’t be afraid to adjust your list during the 45-day window if something better comes along. A well-thought-out identification list gives you flexibility, but once the ID Period closes, your options are locked. Step 4: Purchase Your Replacement Property Once you’re under contract to purchase a replacement property, your QI will coordinate with the title company to wire the exchange funds. If you’re buying multiple properties, you’ll work with your QI to allocate the funds appropriately. A few key rules to keep in mind: If you use all your exchange funds on one purchase, the exchange is complete. If you have remaining funds and no other identified properties, the exchange ends and the leftover funds are taxable. This is known as a partial exchange, and it’s a strategy some investors use intentionally. If you’ve identified multiple properties, you can continue purchasing until the funds are exhausted or the 180-day period ends. Ten31 Texas Tip: Always have a backup property identified in case your first choice falls through. Delays in closing, especially with new construction or complex transactions, can jeopardize your exchange. Navigate Your 1031 Exchange with Confidence A 1031 Exchange offers flexibility, tax advantages, and strategic growth opportunities for real estate investors. With the right planning and a knowledgeable Qualified Intermediary, you can navigate the process confidently and make the most of your reinvestment. Have questions about the 1031 Exchange timeline? We're here to help!

Why Choose a 1031 Improvement Exchange? A 1031 Improvement Exchange can be a great way for property investors to turn what would otherwise be a partial exchange “with Boot” into a full Exchange which defers capital gains tax. Boot refers to the excess cash created when a Replacement Property is purchased for a lower price than the Relinquished Property is sold for, and this difference is taxable. However, if the Replacement Property is a candidate for Improvements that can be completed within the 180-day 1031 Exchange timeline requirement, a 1031 Improvement Exchange can be used. To take full advantage of a 1031 Improvement Exchange, investors often focus on efficiently using up the excess cash for improvements that will add the most value to the property, such as clearing land, enhancing driveways, adding or repairing fencing, replacing roofs or remodeling the interior. Note, when determining where to focus, investors need to consider that improvements which require complex planning or permitting can be difficult to accomplish in a limited time frame.

Why Choose a 1031 Reverse Exchange? A 1031 Reverse Exchange allows investors to capitalize on lucrative investment opportunities without being constrained by the immediate sale of their existing property, which results in greater flexibility and control over their investment decisions. The 1031 Reverse Exchange is more commonly used when an Exchanger: Finds the exact Replacement Property they want to purchase and doesn’t want to risk losing it Needs time to transition a business to a new location while minimizing or eliminating downtime

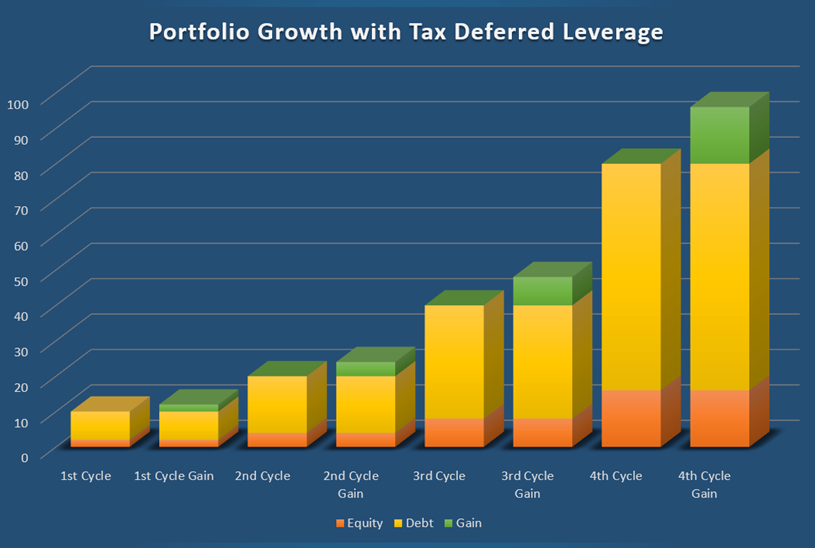

Investing in real estate is not just about owning properties; it's about growing wealth over time. One of the most effective tools for maximizing the potential of your real estate investments is the 1031 Exchange. In this section, we'll explore how a well-executed 1031 Exchange can lead to the realization of wealth multiplication and substantial portfolio growth. The accumulation of equity gains in a property over time creates a remarkable snowball effect. As you make mortgage payments and the property appreciates, your equity stake increases. The longer you hold a property, the faster this effect grows. For instance, if you initially invest with a 20% equity stake, this percentage can increase as your property appreciates and mortgage balance reduces. As a result, your wealth potential multiplies. Portfolio Growth A well-executed 1031 Exchange can be a game-changer for your real estate portfolio. By capturing equity gains and transitioning into new properties while deferring these tax liabilities, investors can witness significant portfolio growth. The key to this strategy is repetition. With each 1031 Exchange cycle, you continue to leverage your equity gains, allowing your portfolio to expand exponentially, all while enjoying the benefits of tax deferment. This approach enables you to make the most of your assets' appreciation, maintain steady growth, and ensure that your wealth multiplication is optimized.

Most investors have heard that the IRS requires a 1031 Exchange to be completed within a maximum time period of 180 days from start to finish, but what many don’t realize is that IRS Section 1031 actually imposes two possible deadlines, and it applies whichever one occurs first. The most well-known deadline is, or course, the 180-day maximum, but the second one that could cut that period short is the Due Date for the Taxpayer's Tax Return. Say you sell your relinquished property late in the year, sometime after October 18 th , which means that your 180-day exchange period would extend beyond April 15 th of the following year. If you are filing an individual or joint tax return, including LLC's reporting on an individual or joint tax return, the Exchange Period would be limited by the earlier April 15 th Tax Due Date. The most extreme example of this would be an exchange that begins with a sale on December 31st, which would leave only 105 days left until April 15 th . Luckily the solution is simple, if you need the extra time to complete the exchange, make sure to file an extension that extends the Due Date for your tax return beyond the end of the 180-day Exchange Period. This will ensure that you get your full 180 days to complete the Exchange. Logically this rule does make sense because filing a 1031 Exchange requires two parts. The first is reporting the sale of the relinquished property asset and the second is reporting what you received in exchange, which would be one or more replacement properties. It would not be possible to report the outcome of the exchange until all purchases were complete, so filing a tax return in the middle of the process would not work. The other outcome of this provision is to ensure that all 1031 Exchanges are reported in the tax filing year in which the Exchange started and are not carried over into the next tax filing year.